What you need to know.

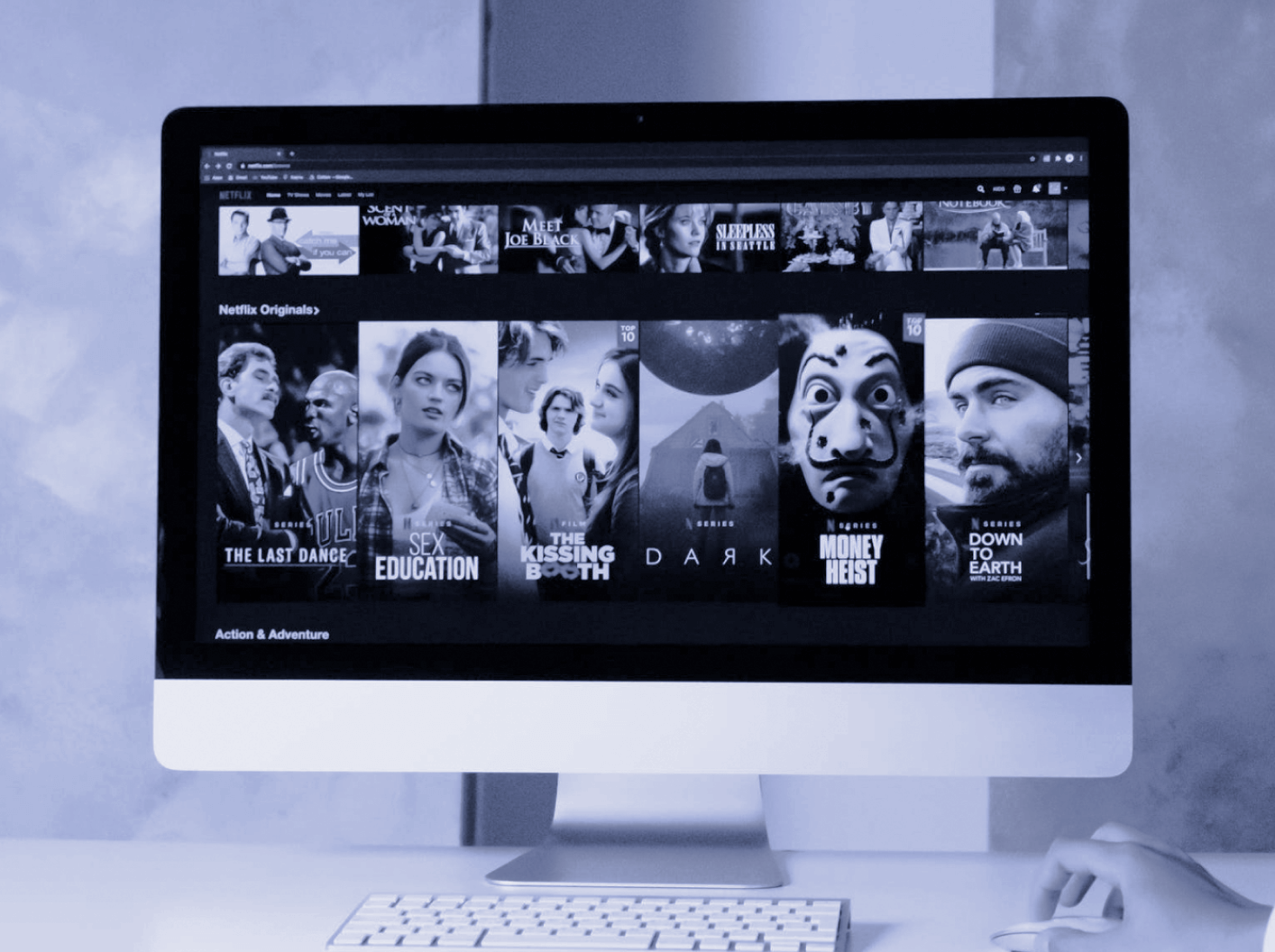

Now that consumers are no longer confined to their homes, the ongoing streaming wars are heating up. Streamers know that with more options in entertainment, both online and in-person, consumers are faced with the choice of which streaming services to keep and which get the blip.

Plus, with constantly increasing monthly fees and Disney+ recently overtaking Netflix in total subscribers, despite popular original content on the platform, each move streamers make could end up being their last – RIP Quibi, we barely knew you.

What the data says.

Historically, Netflix subscribers have been fairly price inelastic, absorbing price increases with ease. The price increases in 2017 and 2019 had little impact on the subscriber base as the 6 month moving average growth rate of transactions largely hovered around zero. Covid increased the subscriber base substantially giving Netflix confidence to continue to increase the price of their service. However, the most recent price increases have been met with resistance from the subscriber base. Reopening, coupled with those price increases, has led to the largest decline in domestic Netflix subscribers in recent history with the 6 month moving average of transaction growth falling to -5% with continued declines in 2022.

For years, people have questioned how much pricing power Netflix has over its subscribers and it appears that those subscribers may be reaching their limit.

Get the Full Report

Download the Sector Report below to drill down into the data and learn more about how each streamer has been performing based on sales, customer sentiment and more – up to the last 3 months.

Ready for more? To access up-to-date custom sector reports with a daily cadence, and to view quantitative and qualitative trends that fuel your work, contact sales@joindrop.com.

Download the Streaming Wars Report

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.